do nonprofits pay taxes on investment income

Below well detail two scenarios in which nonprofits pay tax on investment income. This form is due on the 15th day of the 5th month following the end of the Non-Profits fiscal year.

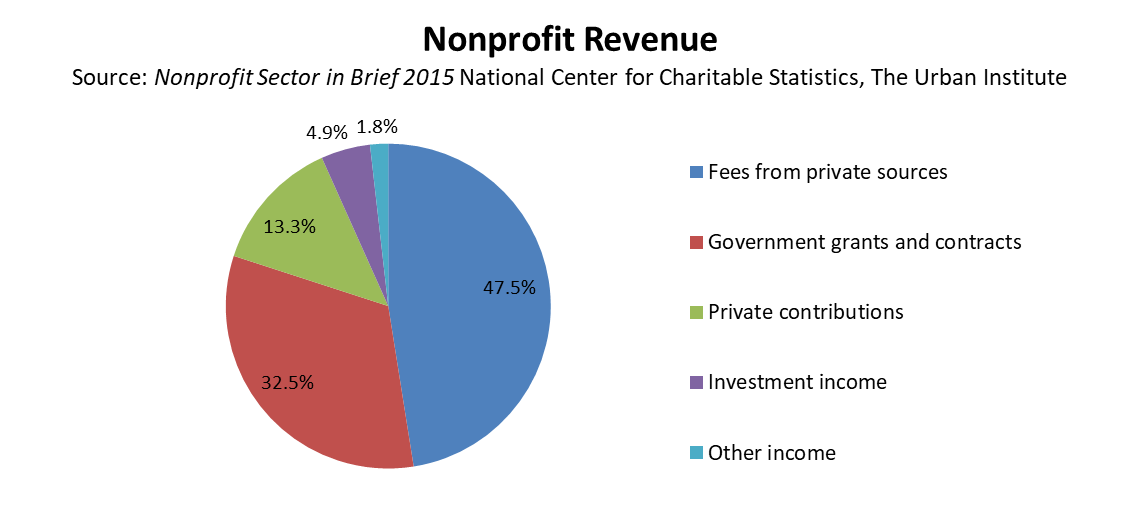

Sources And Uses Of Incomes In The Nonprofit Sector

Which Taxes Might a Nonprofit Pay.

. UBI can be a difficult tax area to navigate for non-profits. Many nonprofits hold stocks in their endowment accounts. When the donated endowment accrues dividends capital gains and.

An exempt operating foundation is not subject to the tax. While a qualified Non-Profit does not have to pay any taxes it still must file a Form 990 with the IRS every year. A non-profit organization NPO as described in paragraph 149 1 l of the Income Tax Act.

Investment income may also be subject to an additional 38 tax if youre above a certain income threshold. Up to 25 cash back While nonprofits can usually earn unrelated business income without jeopardizing their nonprofit status they have to pay corporate income taxes on it under both state and federal corporate tax rules. For example if your nonprofit earns any income from activities unrelated to its purpose it will owe income taxes on that amount.

The tax rate on capital gains for most assets held for more than one year is 0 15 or 20. And the IRS doesnt treat profits the nonprofit earns from investments differently than other donations. A tax-exempt sector can refer to either a market niche comprised of investment vehicles or non-profit organizations exempt from federal.

Answer 1 of 5. There are some instances when nonprofits and churches are still required to pay taxes. Any nonprofit that hires employees will also.

Perhaps the most impactful investment characteristic of a non-profit organization is its tax-exempt status. Do nonprofits pay taxes on investment income. Investment Income Tax Exempt Income from dividends interest annuities payments on security loans and other income from your organizations ordinary and routine investments is not considered UBTI and therefore is tax exempt.

Internal Revenue Code Section 4940 imposes an excise tax on the net investment income of most domestic tax-exempt private foundations including private operating foundations. This includes capital gain dividends received from a regulated investment company. The full Form 990 is for non-profit organizations with gross receipts greater than or equal to 200000.

In short the answer is both yes and no. For tax years beginning on or before Dec. Investment income is reported on Line 10 of.

Tax-exempt organizations report their income from stock investments on Form 990 which is the annual informational return tax-exempt organizations must file. The donations contributed to the endowment fund are tax-deductible for the individuals or companies offering the donation. But determining what are an organizations exempt purposes is not always as clear as one might think and distinguishing between related and unrelated activities can be tricky.

Although 501c3 organizations dont pay tax the IRS requires them to report revenue and expenses just like a company that is subject to tax. Monday April 25 2022. For the most part nonprofits and churches are exempt from the majority of taxes that for-profit businesses are responsible for.

However Private Foundations will pay tax on investment income if they do not distribute sufficient funds for charitable purposes during the year. The first is when your nonprofit incurs debt to acquire an income-producing asset. In general 501c3 charities do not pay tax on capital gains.

It is intended to prevent tax evasion by US. Non-profit Tax-Exempt Status. While nonprofits can usually earn unrelated business income without jeopardizing their nonprofit status they have to pay corporate income taxes on it under both state and federal corporate tax rules.

This guide is for you if you represent an organization that is. 20 2019 the excise tax is 2 percent of net investment income but. Tax on Net Investment Income.

Generally the first 1000 of unrelated income is not taxed but the remainder is. Although dividends interest rents annuities and other investment income generally are excluded when. When your nonprofit incurs debt to acquire an income-producing asset the portion of the income or gain thats debt-financed is generally UBTI.

While nonprofits are generally tax-exempt they must pay income tax when operating outside the scope of their exempt purposes. In figuring the tax on net investment income a private foundation must include any capital gains and losses from the sale or other disposition of property held for investment purposes or for the production of income. Below well detail two scenarios in which nonprofits pay tax on investment income.

Do nonprofits pay taxes. Form 990-EZ which is a much shorter version of the main form is for nonprofits with gross receipts between 50000 and 200000. For the most part nonprofits are exempt from most individual and corporate taxes.

Investment Income Tax Exempt Income from dividends interest annuities payments on security loans and other income from your organizations ordinary and routine investments is not considered UBTI and therefore is tax exempt. Tax-exempt organizations are eligible to make investments in stocks bonds and other financial instruments. However they arent completely free of tax liability.

However there are two exceptions where this type of income is taxable. If it ends with the calendar year then the Form must be filed by May 15th. Capital gains taxes on most assets held for less than a year correspond to ordinary income tax rates.

The major sub-sectors where investment income exceeds 5 percent of income are artsculture education health care disease-related organizations public safety and disaster relief youth development human services community improvement research. There are certain circumstances however they may need to make payments. Which Taxes Might a Nonprofit Pay.

If the foundation sells or otherwise disposes of property used in the production of. An agricultural organization a board of trade or a chamber of commerce as described in paragraph 149 1 e of the Act. Although dividends interest rents annuities and other investment income generally are excluded when calculating a not-for-profits unrelated business income tax UBIT there are two exceptions.

In short the answer is both yes and no. Excluding foundations one in five nonprofits receives at least 5 percent of its income from investments. Given their status as a 501c3 entity nonprofits are provided an income tax exemption that applies to.

Do nonprofits pay income tax on investments. Then theres Form 990-N commonly known as an electronic postcard which is for nonprofits with gross.

Smart Ways To Give To Charity At Year S End This Retirement Life Donate To Charity Charitable Gifts Charity

Our 2013 Rental Profit Loss Statement Schedule E Http Www Rentalrealities Com 2013 Profitloss Sta Profit And Loss Statement Good Essay Bookkeeping Business

Sources And Uses Of Incomes In The Nonprofit Sector

Annual Income Tax Filling Free Ads Classified Income Tax Income Tax Return Tax Return

Investment Return Considerations For Nonprofits Implementing The New Financial Statement Presentation Framework Aafcpas

Nonprofit Income Streams An Introduction Nonprofit Accounting Academy

Benefits Of Bookkeeping Bookkeeping Accounting Benefit

Nominal Investment Income Of U S Households And Nonprofits Equitable Growth

Reit Might Sound Intimidating At First But It S Really A Very Simple Concept Think Of It As A Mutual Fun Investing Money Strategy Business Money

Legal Entity Options For Worker Cooperatives Grassroots Economic Organizing Worker Cooperative Economics Cooperation

Sources And Uses Of Incomes In The Nonprofit Sector

What Is The Benefit Of Tax Deferred Growth Great American Insurance

Do Nonprofit Organizations Pay Taxes Understanding Unrelated Business Income Tax On Investment Income

Common Ubit Myth Related To Nonprofit Revenue And Tax Impact Nonprofit Accounting Basics

When Does Your Nonprofit Owe Ubit On Investment Income Marks Paneth

Are 501c3 Stock Investment Profits Tax Exempt Turbotax Tax Tips Videos

Non Profit Tax Exemptions Tax Exemption Non Profit Federal Income Tax

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)